Safe Harbor Guide

Thank You

Click the button below to begin your download, please contact us if you have any questions.

A match made for your retirement.

Turbo-charge your employees’ retirement savings by adding an employer-matching feature to your company’s 401(k).

What is Employer Matching?

Employer match is a common 401(k) feature that enables the employer to contribute to an employee’s retirement.

How it works

There are three common types of employer match: dollar-for-dollar, stretch, and dollar amount.

Why offer it?

It incentivizes employees to save for retirement and helps employers create a competitive benefits package.

How Fisher\SMB™ can help

There are many options when it comes to employer matching programs. Fisher\SMB helps business owners tailor their matching strategy to their individual needs.

GUide

Safe Harbor

Learn how businesses utilize a Safe Harbor employer-matching feature to pass compliance testing and help employees save more for retirement.

There are four primary ways to implement a 401(k) employer match:

Dollar for Dollar Match

An employer will match employee contributions dollar-for-dollar up to a certain percentage of the employee’s total compensation. For example, a 100% match of up to 3% of an employee’s compensation.

Stretch

Match

An employer matches 50% of employee contributions up to a certain percentage of the employee’s total compensation. For example, a 50% match of up to 8% of an employee’s compensation, for a total match of 4% of the employee’s salary.

Dollar Amount Match

An employer matches a set dollar amount to each employee. For example, an employer matches the first $5,000 of an employee’s contribution to the plan.

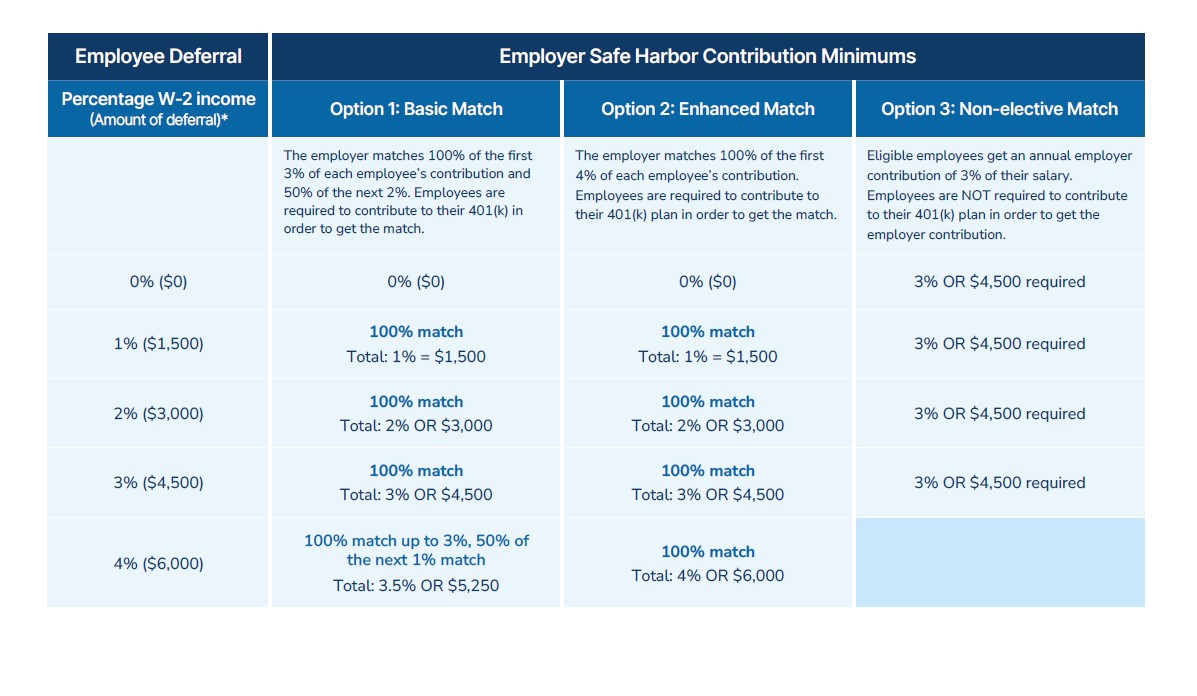

Safe Harbor Match

An employer uses one of three Safe Harbor strategies to automatically pass compliance testing: a non-elective contribution, a basic Safe Harbor match, and an enhanced Safe Harbor match.

Downloadable Chart

Safe Harbor Contribution Chart

Compare different Safe Harbor options to help your plan automatically pass compliance testing.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(888) 674-4504